Looking to boost your subscription business? Here's a quick rundown of the best subscription management tools:

- Younium: Best for B2B subscription billing

- Chargebee: Best for complex tech setups

- Maxio: Ideal for financial compliance

- Recurly: Excels at recovering lost revenue

- Stripe Billing: Perfect for global businesses

- UniBee: Best for teams needing full subscription billing control

Quick Comparison:

| Software | Best For | Key Feature | Starting Price |

| Younium | B2B billing | End-to-end B2B quote-to-cash | Custom |

| Chargebee | Tech integration | 30+ payment gateways | $0/month |

| Maxio | Financial accuracy | GAAP/IFRS compliant | $599/month |

| Recurly | Saving revenue | 70% payment recovery | $149/month |

| Stripe Billing | Global reach | 135+ currencies | $0/month |

| UniBee | SaaS billing | Open-source and cloud accessibility | $0/month |

These tools automate billing, reduce errors, and help you make data-driven decisions. Choose based on your specific needs - whether it's integrations, global reach, or financial compliance.

Related video from YouTube

sbb-itb-d1a6c90

1. Younium: B2B Subscription Billing Platform

Younium is a subscription management and billing platform designed for B2B SaaS companies with complex contracts and pricing models. It focuses on automating billing and revenue workflows across the full subscription lifecycle.

Revenue Tools

Younium’s revenue tools are built to handle real-world B2B subscription complexity:

- Recurring, usage-based, and hybrid billing models

- Contract-based billing with upgrades, downgrades, and renewals

- Automated proration and billing adjustments

- End-to-end quote-to-cash workflows

Integration Options

Younium integrates with common tools used by B2B SaaS teams:

| Category | Examples |

| CRM | Salesforce |

| Accounting | NetSuite, QuickBooks |

| Payments | Stripe |

| Reporting | BI and financial reporting tools |

These integrations help sales, billing, and finance teams work from the same data set.

Pricing Options

Younium does not publish fixed pricing.

- Custom pricing based on billing complexity and revenue volume

- Tailored plans for growing and mid-market B2B SaaS companies

Data and Reports

Younium provides clear visibility into subscription and revenue data:

- Real-time views of recurring revenue and invoicing

- Contract-level revenue tracking

- Finance-ready reporting to support audits and month-end close

Younium is best suited for B2B SaaS companies that need more than basic recurring billing. If managing contracts, pricing changes, and revenue workflows is becoming difficult to scale, Younium offers a structured, finance-friendly alternative.

2. Chargebee: Complete Billing Platform

Chargebee is a heavyweight in subscription management. It's packed with tools to streamline your billing and boost revenue. Here's why it's a top pick:

Revenue Tools

Chargebee's toolkit is built to supercharge your subscription business:

- It automates invoicing from sign-up to recurring payments. No more manual billing headaches.

- You can go global with over 100 currencies supported.

- Its dunning tools can send up to 12 custom emails to customers. This helps keep them around longer.

Integration Options

Chargebee plays well with others. It connects with:

- 30+ payment gateways like Stripe and PayPal

- Accounting software such as QuickBooks and Xero

- CRM systems including Salesforce and HubSpot

- Analytics tools like Google Analytics and Mixpanel

- Support platforms such as Zendesk and Intercom

You can build a tech stack that fits your business like a glove.

Pricing Options

Chargebee's pricing fits businesses of all sizes:

| Plan | Monthly Fee | Revenue Limit |

| Starter | $0 | Up to $100K |

| Rise | $299 | Up to $600K |

| Scale | $599 | Up to $1.2M |

| Enterprise | Custom | Unlimited |

New businesses, take note: The Starter plan lets you use most tools for free until you hit $250,000 in total billing.

Data and Reports

Chargebee gives you the lowdown on your subscription metrics:

- A real-time dashboard shows your active subscriptions and revenue at a glance.

- You can create custom reports on key metrics like MRR, churn rate, and customer lifetime value.

- It automates revenue recognition to keep your finances in check.

"Chargebee's solution is your ticket to platform 9 ¾." - Chargebee Team

This quirky quote hints at how Chargebee can transform your subscription management from ordinary to extraordinary.

If you're looking to scale your subscription model, Chargebee is a solid bet. It combines powerful tools, tons of integrations, flexible pricing, and robust reporting. For companies aiming to max out their recurring revenue, Chargebee is hard to beat.

3. Maxio: Subscription Billing Software

Maxio (formerly SaaSOptics and Chargify) is a subscription billing software that helps businesses boost their revenue. Here's what you need to know:

Revenue Tools

Maxio packs a punch with its revenue tools:

- Fixed and usage-based billing

- Product catalog management

- Customer and subscription tracking

- Automated revenue recognition (GAAP/IFRS compliant)

Integration Options

Maxio plays nice with other business tools:

| Category | Examples |

| Accounting | QuickBooks Online |

| CRM | HubSpot |

| Payments | Stripe |

| Taxes | Avalara |

These integrations help streamline your financial operations.

Pricing

Maxio doesn't list prices publicly. But they do offer a 30-day free trial. So you can test it out before committing.

Data and Reports

Maxio's reporting game is strong:

- Real-time SaaS metrics (MRR, usage analytics)

- Custom dashboards

- Detailed subscription momentum reports

"Maxio saves us from spreadsheet hell. We get the info we need faster and in one place." - Debbie Williams, CFO, EnMark Systems

Finance pros love Maxio's single source of truth for billing, invoicing, and customer data.

What Makes Maxio Stand Out?

- Finance-focused: Great for finance teams

- Scalable: Grows with your business

- Audit-friendly: Simplifies audit prep

But heads up: Maxio might take longer to set up if you have complex needs. And it's not the best for real-time billing with tricky usage-based models.

Bottom line: If you're a SaaS business looking to tighten up your finances and get better insights into your recurring revenue, Maxio is worth a look.

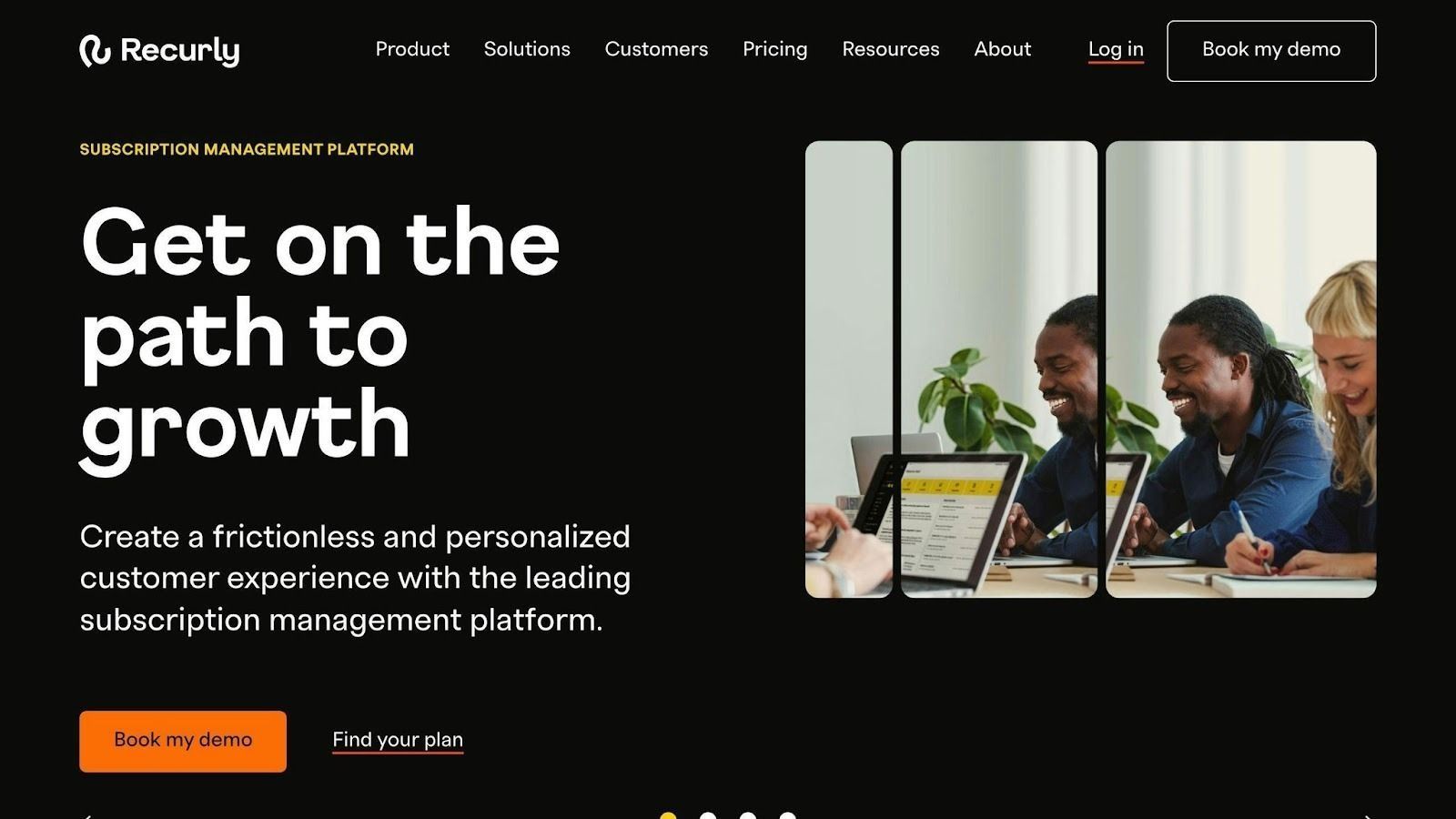

4. Recurly: Payment Management System

Recurly is a subscription management platform for mid-market and enterprise businesses. Here's what it offers:

Revenue Tools

Recurly's tools are designed to boost your subscription revenue:

- Their Revenue Optimization Engine recovers about 70% of failed subscription renewals. That's a big chunk of potential churn, stopped in its tracks.

- Automated billing workflows make life easier for your finance team. Clean data, clear audit trails - it's all there.

- Want to go global? Recurly supports over 135 currencies and 20+ payment gateways.

Integration Options

Recurly plays nice with other tools:

| Integration Category | Examples |

| Accounting | QuickBooks Online, Xero |

| CRM | Salesforce |

| Marketing | MailChimp |

| Customer Support | Zendesk |

| Automation | Zapier |

These integrations mean your data flows smoothly across your tech stack. No more copy-paste marathons.

Pricing Options

Recurly offers three plans:

| Plan | Monthly Fee | Revenue Percentage | Features |

| Core | $149 | 0.9% | Up to 5 users, 1 payment gateway |

| Professional | Custom | Not specified | Up to 20 users, 2 gateways, $10M billing |

| Elite | Custom | Not specified | 20+ users, all gateways, $10M+ billing |

The Core plan is straightforward. For the bigger plans, you'll need to chat with Recurly.

Data and Reports

Recurly's analytics give you a full view of your subscription business:

- A real-time dashboard shows your subscriber data, churn rate, and revenue at a glance.

- Want custom reports? Use the Recurly Explore report builder.

- You can even benchmark your performance against industry standards. See where you stand and where you can grow.

"Recurly's automated and scalable billing workflows help increase efficiencies in our finance processes. Our finance and accounting teams now have access to clean data with clear audit trails for accurate and efficient reporting." - Devin Loftis, Chief Technology Officer, WineDirect

Recurly combines powerful revenue tools, lots of integrations, flexible pricing, and solid reporting. It's a strong option for businesses looking to step up their subscription game. The ability to recover failed payments and dig deep into subscription metrics? That's the kind of stuff that can really impact your bottom line.

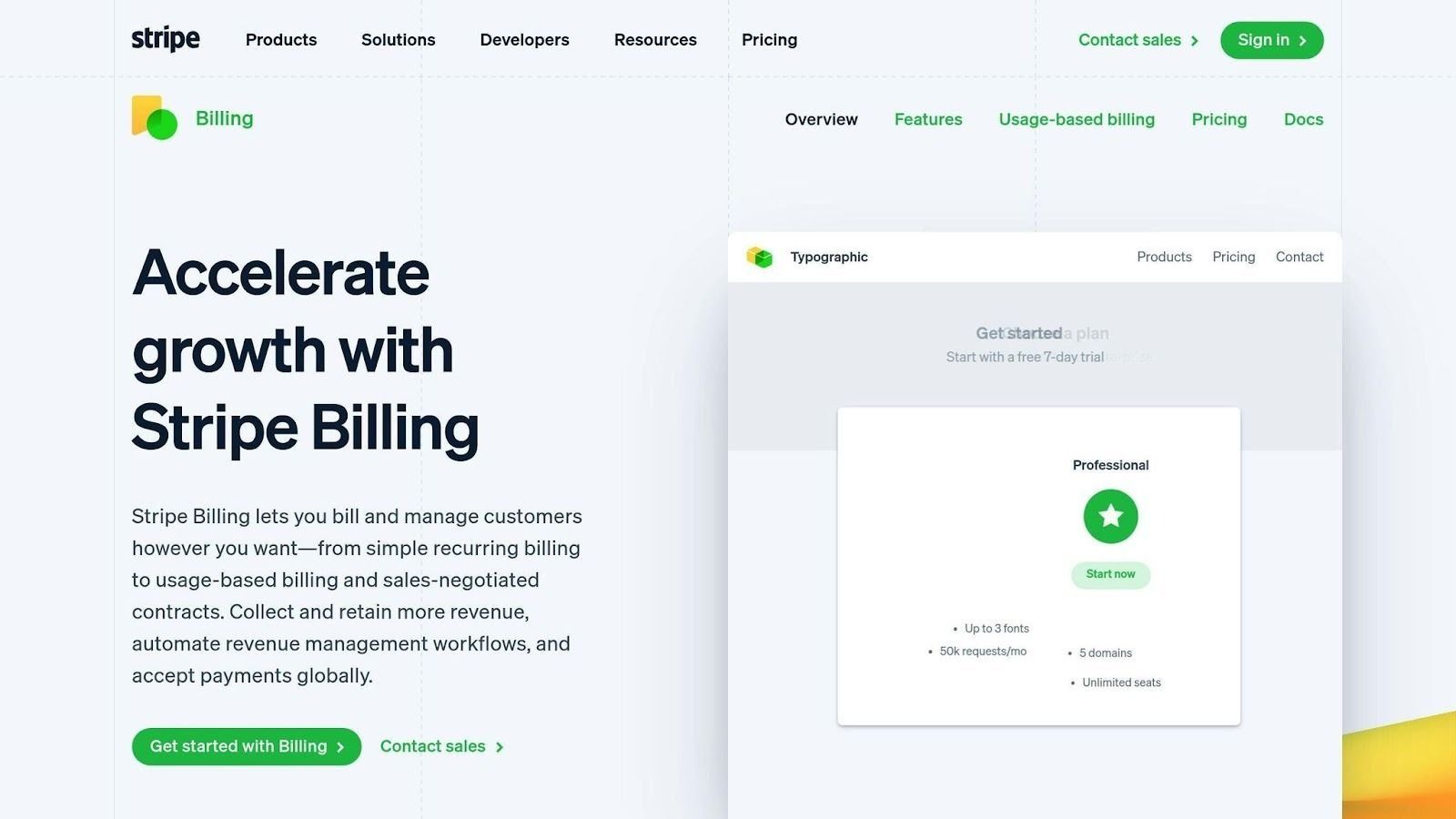

5. Stripe Billing: Payment Processing Tool

Stripe Billing is a subscription management powerhouse. It's part of Stripe's bigger payment processing system. Here's why it's a top pick:

Revenue Tools

Stripe Billing packs a punch when it comes to boosting your subscription revenue:

- It recovers 11% more revenue with smart retries

- On average, it claws back 57% of failed recurring payments

- It handles simple recurring, usage-based, and sales-negotiated contracts

"We've recovered millions in lost revenue. That's huge for us as a subscription business." - Damian Michelfelder, Retool Team

Integration Options

Stripe plays well with others:

- Got WordPress, Shopify, or WooCommerce? There's a plugin for that.

- Need something custom? Their API docs have you covered.

- It speaks 40+ local payment languages and deals in 135+ currencies

Pricing Options

Stripe Billing's pricing flexes to fit your business:

| Plan | Monthly Fee | Transaction Fee | Who It's For |

| Pay as you go | $0 | 0.5% per transaction | Low or unpredictable volume |

| Monthly (up to A$150,000) | A$930 | Included | Steady, higher volume |

| Custom | Let's talk | Let's talk | Big billing volumes |

Data and Reports

Stripe's got your numbers game on lock:

- Craft your own reports with Stripe Sigma

- Track the good stuff: revenue, churn rate, customer lifetime value

- Keep your security tight with the PCI Compliance Dashboard

Stripe Billing is an automation beast. It handles everything from invoices to payments without you lifting a finger. That's gold for businesses scaling up their subscription game.

Going global? Stripe's got 135+ currencies in its pocket. It's perfect if you're eyeing international markets or already playing in that sandbox.

But heads up: Stripe's power comes with a learning curve. If you don't have tech-savvy folks on your team, you might find it trickier than some user-friendly alternatives.

When it comes to keeping the cash flowing, Stripe Billing's recovery tools are the real MVPs. They helped businesses recover over $3.4 billion in 2023 alone. That's not chump change.

If you're after flexibility, room to grow, and top-notch recovery features in your subscription software, Stripe Billing's a solid bet. And if you're already in the Stripe ecosystem (or thinking about it), that's just icing on the cake.

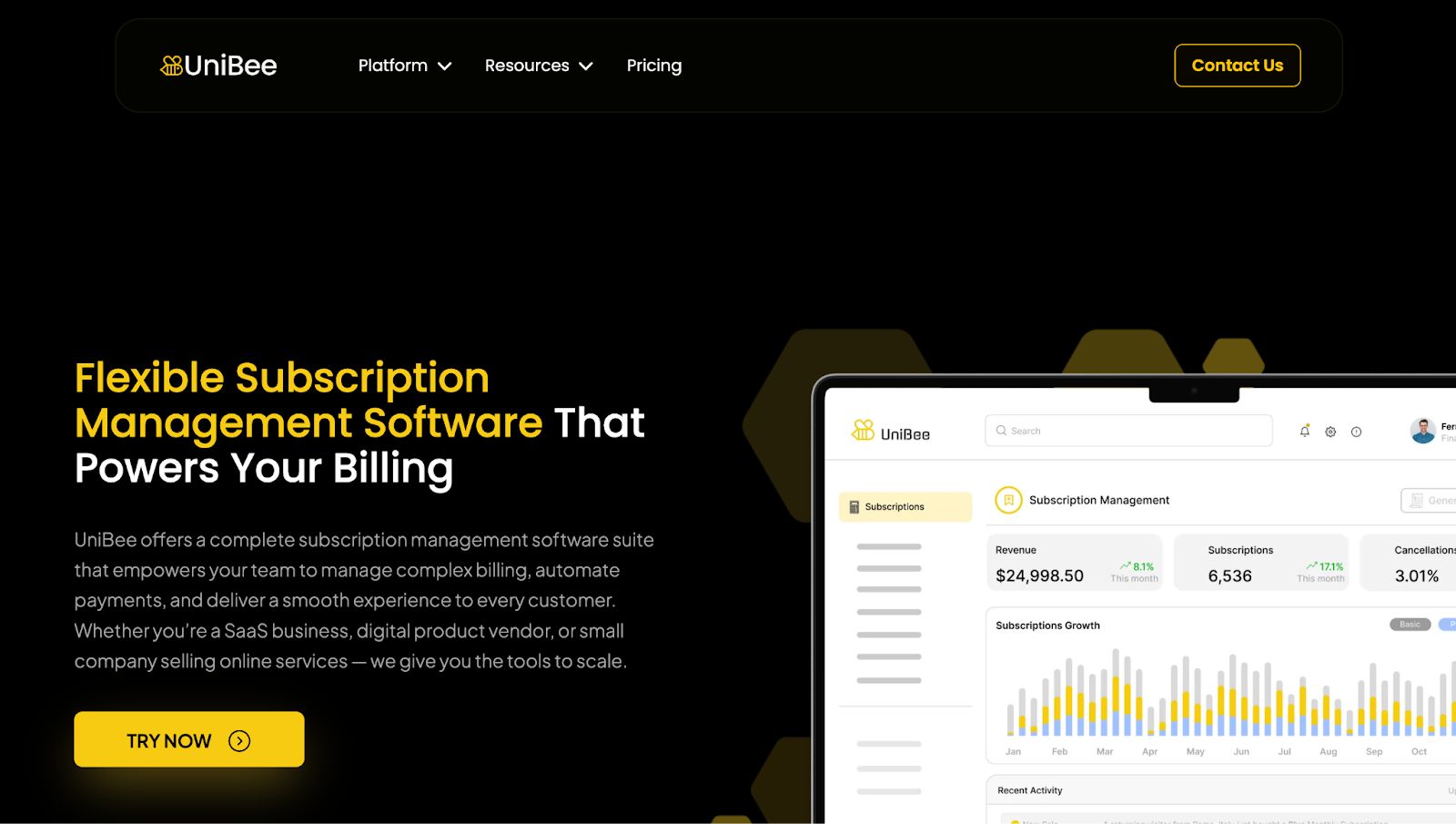

6. UniBee: Open-Source SaaS Billing Solution

UniBee is an open-source subscription and billing platform built for scaling SaaS and digital businesses. Designed to simplify complex billing workflows while maintaining flexibility, it helps teams automate revenue operations without heavy engineering lift. Here’s why it stands out:

Revenue Tools

UniBee’s features are built to handle growth seamlessly:

- Automated billing & invoicing from trial to renewal, reducing manual work.

- Flexible pricing models support usage-based, tiered, flat-rate, and hybrid plans.

- Smart dunning management reduces involuntary churn with customizable retry logic and email sequences.

- Multi-currency & tax compliance ready for global expansion.

Integration Options

UniBee connects deeply with your existing stack:

- Payment gateways: Stripe, PayPal, Payssion, and more

- Accounting tools: QuickBooks, Xero, and more

- CRM & marketing: Salesforce, HubSpot, Wordpress, and more

Analytics: Mixpanel, and more

Its flexible scheme allows for custom integrations tailored to your workflow.

Pricing Options

UniBee offers transparent, scalable pricing:

| Plan | Monthly Fee | What’s Included |

| Open-source | $0/month | Self-hosted and customizable, Manual setup required, Support via community only |

| Starter (cloud) | $99/user/month | Up to 5 billing admins, Cloud-hosted platform, Core billing features, Built-in financial analytics, Advanced integrations, Community-level support, Optional professional services |

| Business (cloud) | $399/user/month | Up to 20 billing admins, Cloud-hosted platform, Core billing features, Built-in financial analytics, Advanced integrations, Dedicated technical support, Optional professional services |

| Advanced | Customizable | Custom admin roles, Cloud or on-prem deployment, Core billing features, Built-in financial analytics, Advanced integrations, Dedicated support, Custom deployment |

Data and Reports

UniBee turns billing data into actionable insights:

- Real-time dashboard tracking MRR, churn, and growth metrics.

- Custom report builder for cohort analysis, revenue recognition, and subscriber trends.

- Automated revenue reporting

If you need a flexible, developer-friendly billing system that grows with you, UniBee offers powerful automation, wide integration capabilities, and clear pricing, making it a strong choice for startups and scaling SaaS companies alike.

Features and Pricing Comparison

Let's compare our top 5 subscription management software solutions. We'll look at their features, pricing, and what makes each one special.

Feature Comparison

| Feature | Younium | Chargebee | Maxio | Recurly | Stripe Billing | UniBee |

| Automated Billing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Revenue Recovery | – | ✓ | ✓ | ✓ | ✓ | ✓ |

| Multi-currency Support | ✓ | 100+ | ✓ | 135+ | 135+ | ✓ |

| Dunning Management | – | ✓ | ✓ | ✓ | ✓ | ✓ |

| Usage-based Billing | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Custom Reports | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

Pricing comparison:

| Software | Starting Price | Free Trial | Revenue Limit |

| Younium | Custom | Demo | - |

| Chargebee | $0/month | Yes | Up to $100K |

| Maxio | $599/month | 30 days | - |

| Recurly | $149/month | Yes | - |

| Stripe Billing | $0/month | - | - |

| UniBee | $0/month | Yes | - |

What Makes Each One Special?

1. Younium

Younium stands out for how it handles complex B2B subscriptions end to end. Instead of focusing only on billing or payments, it connects quotes, contracts, billing, and revenue into one workflow. This makes it easier for B2B SaaS companies to manage long-term contracts, pricing changes, and usage-based billing without relying on spreadsheets or manual fixes.

2. Chargebee

Chargebee is the king of connections. It hooks up with over 30 payment gateways and tons of accounting, CRM, and analytics tools. If you've got a complex tech setup, Chargebee's got your back.

"Chargebee's automated and scalable billing workflows help increase efficiencies in our finance processes." - Devin Loftis, Chief Technology Officer, WineDirect

3. Maxio

Maxio (formerly SaaSOptics and Chargify) is all about the numbers. It's got automated revenue recognition that follows GAAP/IFRS rules. If you're big on financial accuracy and being audit-ready, Maxio's worth a look.

4. Recurly

Recurly's secret weapon? Its Revenue Optimization Engine. They say it saves about 70% of failed subscription renewals. That's a lot of money that could've slipped through the cracks.

5. Stripe Billing

Stripe Billing rides on Stripe's payment processing power. It handles both subscriptions and one-time payments like a champ. In 2023, Stripe helped businesses save over $3.4 billion in payments that almost got away.

5. UniBee

UniBee points out its flexibility and control, especially for growing SaaS and digital businesses. The design is for teams that want to automate recurring billing without tight ownership, transparency, or the ability to tailor the system to their exact needs.

"We've recovered millions in lost revenue. That's huge for us as a subscription business." - Damian Michelfelder, Retool Team

The Bottom Line

- Running complex B2B subscriptions with contracts and pricing changes? Younium is built for that.

- Need to connect with everything? Go for Chargebee.

- Want more than just subscription management? Check out BizBot.

- Is financial compliance your top concern? Look into Maxio.

- Want to save as much revenue as possible? Recurly's your best bet.

- Already using Stripe or need flexibility in payment types? Stripe Billing's a no-brainer.

Which Tool Should You Choose?

Picking the right subscription management software can make or break your revenue strategy. Let's look at which tool might work best for you:

Younium: For Complex B2B Subscription Models

If your business runs on contract-based subscriptions, usage-based pricing, or frequent amendments, Younium is worth considering. It’s built for B2B SaaS teams that need structure across quoting, billing, and revenue workflows - especially once basic billing tools start to fall short.

Chargebee: For Tech-Heavy Setups

Got a complex tech stack? Chargebee's your friend. It plays nice with over 30 payment gateways and tons of accounting, CRM, and analytics tools.

"Chargebee's automated billing workflows boost our finance processes." - Devin Loftis, CTO, WineDirect

Stripe Billing: For Going Global

Want to conquer the world? Stripe Billing handles 135+ currencies. In 2023, it helped businesses recover $3.4 billion. Perfect for international expansion.

Maxio: For Financial Sticklers

If you're all about financial compliance and being audit-ready, check out Maxio (previously SaaSOptics and Chargify). Its automated revenue recognition follows GAAP/IFRS rules. Finance teams love it.

Recurly: For Saving Lost Revenue

Recurly's Revenue Optimization Engine is no joke. They claim to save about 70% of failed subscription renewals. That's a lot of cash back in your pocket.

UniBee: For Teams That Want Full Control

If off-the-shelf billing tools feel too limiting, UniBee is worth a look. It’s an open-source subscription and billing platform built for SaaS and digital businesses that want flexibility over pricing, workflows, and payment system.

Here's a quick comparison:

| Feature | Younium | Chargebee | Stripe Billing | Maxio | Recurly | UniBee |

| Starting Price | Custom | $0/month | $0/month | $599/month | $149/month | $0/month |

| Best For | B2B billing | Tech integration | Global reach | Financial accuracy | Saving revenue | Full control billing |

| Key Feature | End-to-end B2B quote-to-cash | 30+ payment gateways | 135+ currencies | GAAP/IFRS compliant | 70% payment recovery | Open-source and cloud |

Choose wisely. Your revenue depends on it.