Tax preparation can be daunting for small businesses, but tax software simplifies the process, ensuring compliance, maximizing savings, and providing convenience. Here are the top 10 tax software options for small businesses in 2024:

- TurboTax: Feature-rich with expense tracking, self-employment income reporting, and expert support. Pricing starts at $120 for federal filing.

- H&R Block: Step-by-step guidance, deduction finder, audit support, and mobile app. Pricing starts at $55 for federal filing.

- QuickBooks Online: Automatic tax calculations, financial reports, and accounting tool integration. Pricing starts at $10/month.

- TaxAct: Accurate calculations, customizable reports, multi-state filing, and audit protection. Pricing starts at $24.99 for federal filing.

- Jackson Hewitt: Flat-rate pricing, unlimited state returns, tax professional help, and accuracy guarantee. $25 for federal and state filing.

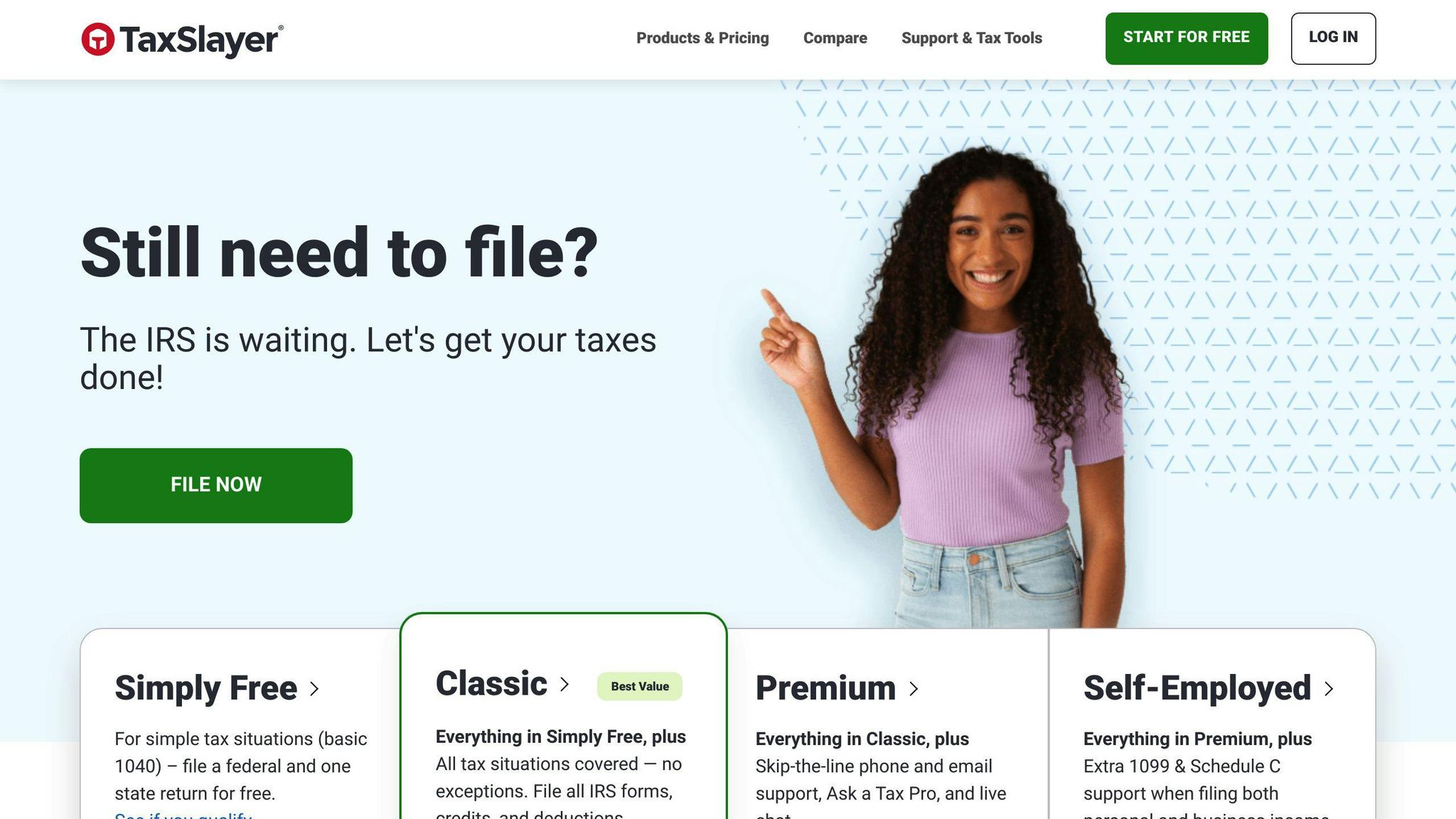

- TaxSlayer: Unlimited state returns, tax professional help, and accuracy guarantee. Pricing starts at $34.95 for federal filing.

- FreeTaxUSA: Free federal filing, affordable state filing, self-employed support, and audit assistance. Pricing starts at $14.99 for state filing.

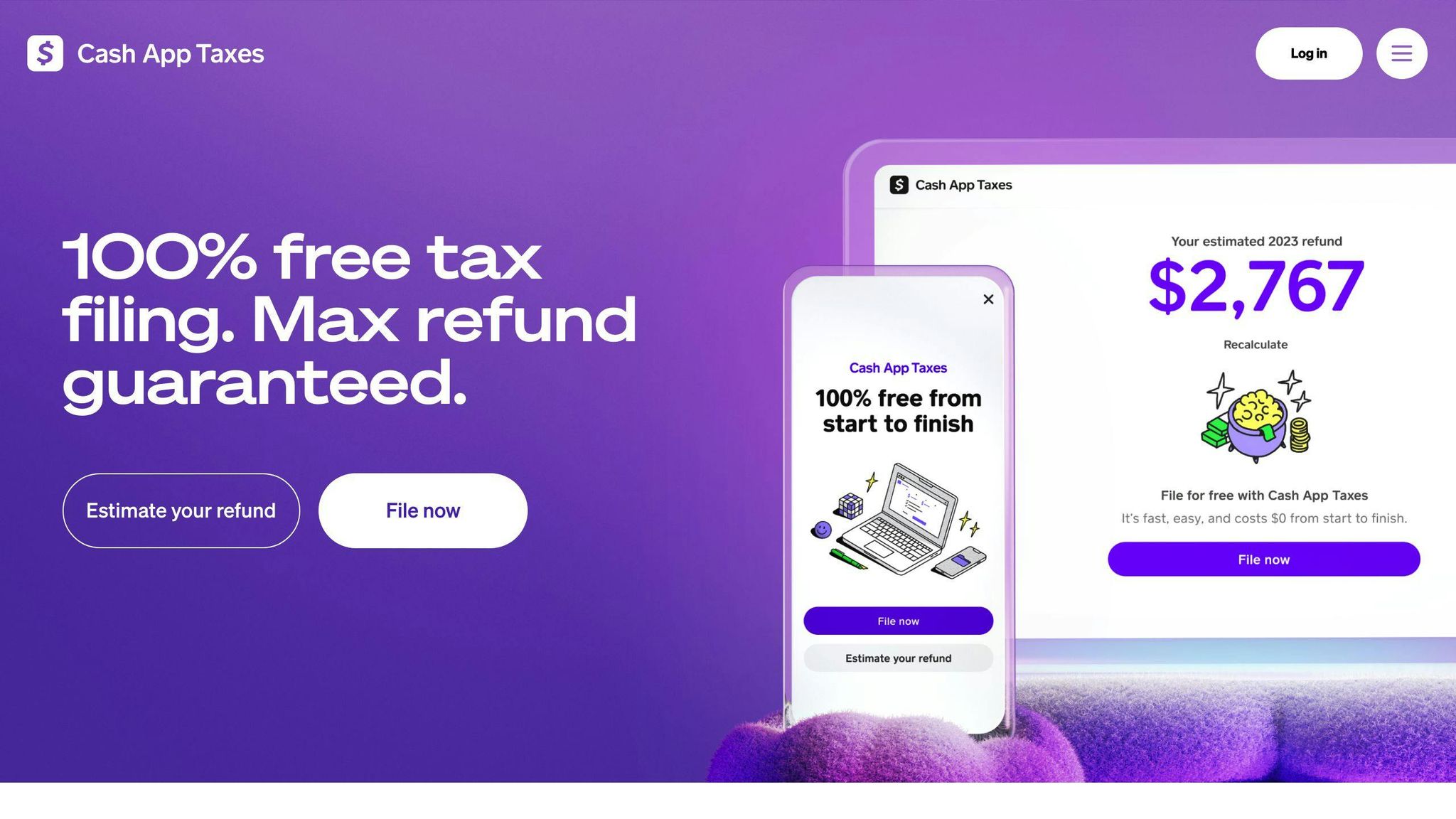

- Cash App Taxes: Free federal and state filing, audit support, and supports major IRS forms.

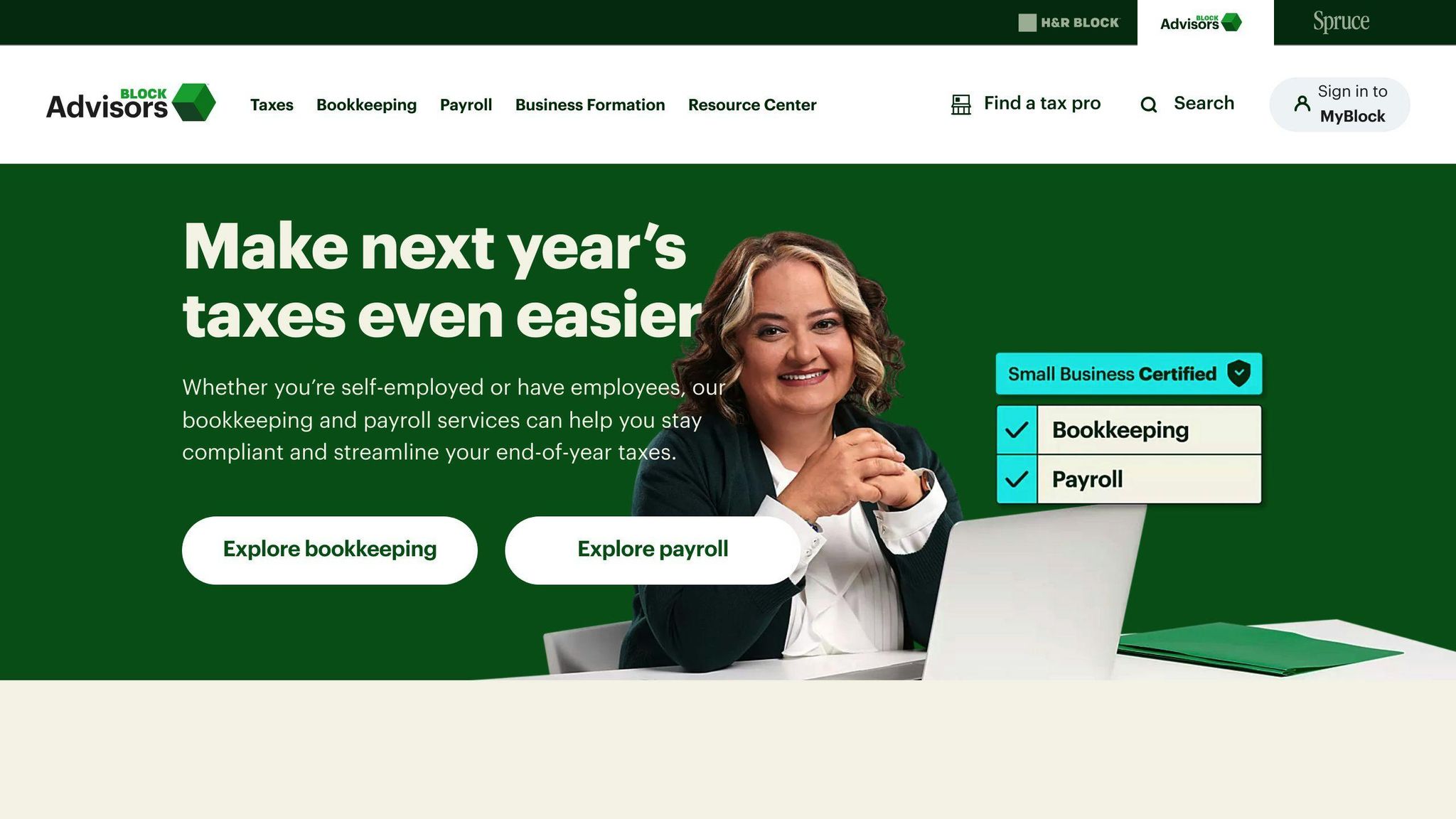

- Block Advisors: Tax preparation, bookkeeping, payroll, business formation, and tax consulting services.

- BoomTax: ACA reporting, W-2 and 1099 filing, TIN verification, and unlimited corrections. Pricing starts at $349 per company.

Related video from YouTube

Quick Comparison

| Software | Federal Filing | State Filing | Key Features |

|---|---|---|---|

| TurboTax | $120 - $170 | $50 - $55 | Expense tracking, self-employment income reporting, expert support |

| H&R Block | $55 - $115 | $49 | Deduction finder, audit support, mobile app |

| QuickBooks Online | N/A (monthly pricing) | N/A | Automatic tax calculations, financial reports, accounting integration |

| TaxAct | $24.99 - $159.99 | $44.99 - $54.99 | Accurate calculations, customizable reports, multi-state filing |

| Jackson Hewitt | $25 | Included | Flat-rate pricing, unlimited state returns, tax professional help |

| TaxSlayer | $34.95 - $64.95 | $39.95 | Unlimited state returns, tax professional help, accuracy guarantee |

| FreeTaxUSA | Free - $14.99 | $14.99 | Free federal filing, self-employed support, audit assistance |

| Cash App Taxes | Free | Free | Free federal and state filing, audit support, supports major IRS forms |

| Block Advisors | $115 - $220+ | Included | Tax preparation, bookkeeping, payroll, business formation |

| BoomTax | $349+ | N/A | ACA reporting, W-2 and 1099 filing, TIN verification |

Choose the tax software that best fits your business needs, budget, and preferences for features, ease of use, and customer support.

Evaluation Criteria

When choosing tax software for your small business, consider these key factors:

Features

The software should offer features suited to your business needs, such as:

| Feature | Description |

|---|---|

| Electronic Filing | File taxes online and import W-2 and 1099 forms |

| Tax Return Storage | Save previous tax returns for reference |

| Deduction Suggestions | Get guidance on eligible deductions and credits |

| State Tax Filing | File state income tax returns if needed |

Cost

Look for affordable options that provide good value for money. Compare pricing and discounts.

User-Friendliness

The software should be easy to use, with a simple interface and clear instructions, even for non-tech users.

Support

Reliable customer support is crucial. Check if the software offers phone, email, chat, or in-person assistance when needed.

1. TurboTax

Features

TurboTax is a tax preparation software packed with features for small businesses:

- Electronic Filing: File taxes online and import W-2 and 1099 forms

- Tax Return Storage: Access previous tax returns for reference

- Deduction Guidance: Get help identifying eligible deductions and credits

- State Tax Filing: File state income tax returns if needed

- Business Expense Tracking: Easily track and categorize business expenses

- Self-Employment Income Tracking: Accurately report self-employment income and expenses

Pricing

| Plan | Federal Filing | State Filing (per state) |

|---|---|---|

| Self-Employed | $120 | $50 |

| Business | $170 | $55 |

User Experience

TurboTax offers a user-friendly interface, guiding small business owners through a step-by-step process for accurate and compliant tax returns.

Customer Support

Get reliable support through:

- Phone

- Chat

- Knowledge base and FAQs

- Live assistance from CPAs and EAs (additional fee)

2. H&R Block

Features

- Step-by-Step Tax Preparation: The software guides you through each section with easy questions and explanations, similar to working with a tax professional.

- Deduction Finder: Helps identify potential tax deductions and credits you may qualify for.

- Audit Support: Get free guidance from tax experts if you receive an IRS notice, or purchase additional audit representation services.

- Import Previous Returns: Easily transfer your information from last year's tax return to save time.

- Mobile App: Access your tax return and upload documents from your mobile device.

Pricing

| Plan | Federal Filing | State Filing (per state) |

|---|---|---|

| Deluxe | $55 | $49 |

| Premium | $85 | $49 |

| Self-Employed | $115 | $49 |

User Experience

H&R Block's online tax software has a clean and straightforward interface, making it easy to navigate through each section of your tax return. The software provides clear explanations and guidance throughout the process, ensuring you understand each step.

Customer Support

H&R Block offers multiple support channels, including:

- Phone and chat support from tax experts

- Online help center with articles and FAQs

- In-person assistance at H&R Block retail locations (additional fees may apply)

3. QuickBooks Online

Features

QuickBooks Online offers helpful features for small businesses to prepare and file taxes:

- Automatic Tax Calculations: The software calculates taxes owed, reducing errors.

- Detailed Financial Reports: Get a clear picture of your finances and tax obligations.

- Customizable Invoices: Create professional invoices and track payments and expenses easily.

- Accounting Tool Integration: Seamlessly manage financial data from various accounting tools.

Pricing

QuickBooks Online has different pricing plans:

| Plan | Monthly Cost |

|---|---|

| Simple Start | $10 |

| Essentials | $17 |

| Plus | $30 |

| Advanced | $40 |

User Experience

QuickBooks Online has an intuitive interface, making it easy to use, even for beginners. Tutorials and guides help you get started and make the most of the features.

Customer Support

Get assistance through:

- Phone Support: Speak with tax experts and accounting professionals.

- Online Chat: Chat with support agents in real-time.

- Resource Center: Access tutorials, guides, and FAQs for tax preparation and filing.

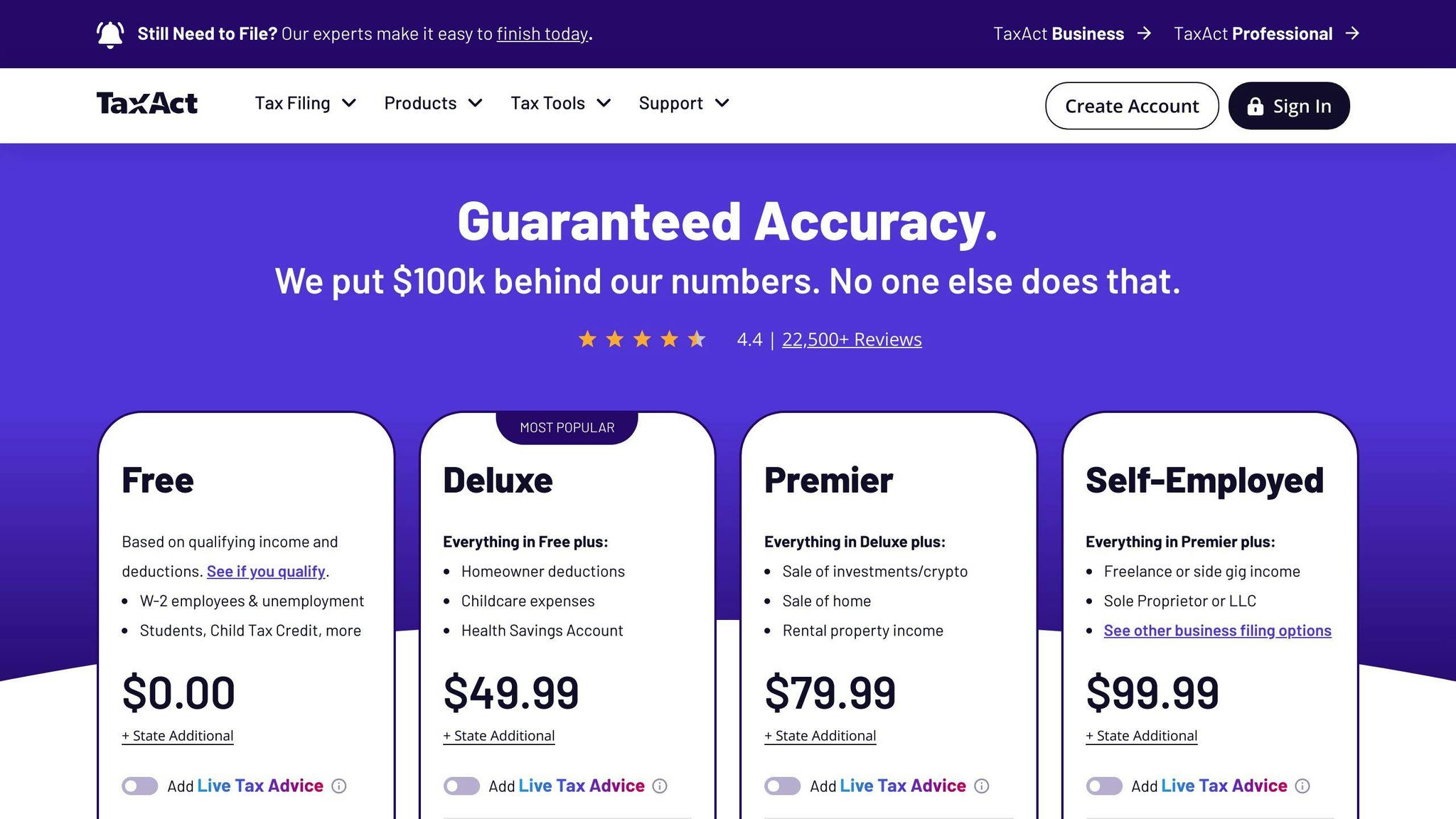

4. TaxAct

Features

TaxAct offers these key features for small businesses:

- Accurate Tax Calculations: The software ensures precise tax calculations, reducing errors and potential penalties.

- Customizable Financial Reports: Generate detailed reports to understand your tax obligations clearly.

- Multi-State Filing: File taxes for multiple states easily, ideal for businesses operating across state lines.

- Audit Protection: Get audit protection and representation from experienced tax professionals.

Pricing

TaxAct provides competitive pricing plans:

| Plan | Federal Return | State Return |

|---|---|---|

| Deluxe | $24.99 | $44.99 |

| Premier | $34.99 | $44.99 |

| Self-Employed | $64.99 | $44.99 |

| Business Returns | $139.99 (Partnerships) / $159.99 (S and C-corps) | $54.99 |

User Experience

TaxAct's user-friendly interface makes navigation easy, even for those new to tax preparation. The software guides you through the process, ensuring you don't miss any deductions or credits.

Customer Support

Get assistance through:

- Phone Support: Speak with tax experts and accounting professionals.

- Online Chat: Chat with support agents in real-time.

- Resource Center: Access tutorials, guides, and FAQs for tax preparation and filing.

TaxAct is an affordable tax software solution for small businesses, offering accurate calculations, customizable reporting, multi-state filing, and audit protection. Its user-friendly interface and comprehensive support make it a practical choice for businesses of all sizes.

5. Jackson Hewitt

Features

Jackson Hewitt offers these key features for small businesses:

- Flat-Rate Pricing: Pay a flat $25 fee for federal and state tax returns, with unlimited state returns included.

- Unlimited State Returns: File taxes for multiple states without extra charges.

- Tax Professional Help: Get expert assistance from a tax pro for an additional cost.

- 100% Accuracy Guarantee: Jackson Hewitt guarantees accurate calculations and will cover any penalties or interest due to their own calculation errors.

Pricing

| Plan | Federal Return | State Return |

|---|---|---|

| Online | $25 | Included with Federal |

User Experience

Jackson Hewitt's online tax software has a simple, uncluttered interface. It guides you through tax preparation step-by-step, making it easy to navigate, even for first-time users.

Customer Support

Get assistance through:

- Live Chat: Chat with tax experts and support agents in real-time.

- Resource Center: Access tutorials, guides, and FAQs for tax preparation and filing.

Jackson Hewitt offers a straightforward tax software solution for small businesses. With flat-rate pricing, unlimited state returns, and expert support, it's a practical choice for businesses of all sizes. The user-friendly interface and comprehensive support resources make tax preparation simple.

sbb-itb-d1a6c90

6. TaxSlayer

Features

TaxSlayer offers several plans to meet different business needs:

- Simply Free: A basic plan for simple tax returns.

- Classic: Includes additional features for more complex returns.

- Premium: Provides advanced tools and support.

- Self-Employed: Designed for self-employed individuals and small businesses.

All plans include:

- Unlimited State Returns: File taxes for multiple states at no extra cost.

- Tax Professional Help: Get expert assistance from a tax pro (additional fee).

- Accuracy Guarantee: TaxSlayer guarantees accurate calculations and covers any penalties or interest due to their errors.

Pricing

| Plan | Federal Return | State Return |

|---|---|---|

| Simply Free | $0 | $0 |

| Classic | $34.95 | $39.95 |

| Premium | $54.95 | $39.95 |

| Self-Employed | $64.95 | $39.95 |

User Experience

TaxSlayer's online tax software has a user-friendly interface, guiding you through tax preparation step-by-step. The software is easy to navigate, even for first-time users.

Customer Support

Get assistance through:

- Live Chat: Chat with tax experts and support agents in real-time.

- Resource Center: Access tutorials, guides, and FAQs for tax preparation and filing.

TaxSlayer offers a range of tax software plans for small businesses, with options for simple to complex tax needs. Key features include unlimited state returns, expert support, and an accuracy guarantee. The user-friendly interface and comprehensive support resources make tax preparation straightforward.

7. FreeTaxUSA

FreeTaxUSA is a tax preparation software made for small business owners, freelancers, and self-employed individuals. It offers features to help with tax filing.

Features

FreeTaxUSA provides these key features:

- Free Federal Filing: For simple returns

- Affordable State Filing: $14.99 per state

- Self-Employed Support: For individuals and small businesses

- Unlimited Deductions and Credits: For businesses

- Audit Assistance: Get help if audited

- Multiple Refund Options: Direct deposit, prepaid debit cards, etc.

Pricing

FreeTaxUSA has a clear pricing structure:

| Plan | Federal Return | State Return |

|---|---|---|

| Basic | Free | $14.99 |

| Advanced | $6.99 | $14.99 |

| Premium | $14.99 | $14.99 |

| Self-Employed | $14.99 | $14.99 |

User Experience

The online software has an easy-to-use interface. It guides users step-by-step through tax preparation.

Customer Support

FreeTaxUSA offers support through:

- Live chat

- Phone

- Resource center with FAQs, guides, and tutorials

FreeTaxUSA is a good option for small business owners and self-employed individuals. It offers useful features, clear pricing, and good customer support for tax filing.

8. Cash App Taxes

Cash App Taxes is a free tax filing software for individuals and small business owners. It offers a simple and easy-to-use interface, making it a convenient option for those who want to file their taxes quickly and efficiently.

Features

Cash App Taxes provides the following key features:

- Free Filing: No fees for federal and state tax returns, regardless of complexity

- No Tax Prep Fees: No fees deducted from your federal refund

- Free Audit Support: Get free audit defense and representation

- Supports Major IRS Forms: Supports most IRS forms and schedules, including W-2, 1099, and Schedule C

Pricing

| Plan | Federal Return | State Return |

|---|---|---|

| Cash App Taxes | Free | Free |

User Experience

The online software has a user-friendly interface that guides you step-by-step through tax preparation. It's available on desktop and mobile devices, allowing you to file your taxes on-the-go.

Customer Support

Cash App Taxes offers technical support via online chat, phone, and social media. While it doesn't provide tax advice, it has an online knowledge center with answers to common tax questions and topics.

Overall, Cash App Taxes is a great option for small business owners and individuals who want to file their taxes quickly and efficiently without any costs.

9. Block Advisors

Block Advisors is a tax preparation service made for small businesses. It offers features to help with taxes, bookkeeping, payroll, and business formation.

Features

Block Advisors provides these key features:

- Tax Preparation: Tax filing services for small businesses, self-employed individuals, S Corps, C Corps, and partnerships

- Bookkeeping: Bookkeeping services to manage finances and stay organized

- Payroll: Payroll services for self-employed and businesses with employees

- Business Formation: Assistance with forming an LLC, S Corp, C Corp, or nonprofit

- Tax Consulting: Access to tax professionals for guidance and advice

Pricing

Block Advisors offers pricing options to fit your business needs:

| Service | Pricing |

|---|---|

| Tax Filing | Starts at $115 for DIY, $220 for full-service |

| Bookkeeping | Starts at $175 per month for full-service |

| Payroll | Starts at $59 per month for self-employed, $79 per month plus $10 per employee, per pay run, for businesses with employees |

| Business Formation | Starts at $149 |

User Experience

Block Advisors has a user-friendly interface to manage tax preparation, bookkeeping, and payroll services. You can also meet with tax professionals via phone, video, or in-person.

Customer Support

Block Advisors provides access to tax professionals who can answer questions and offer guidance. You can reach out to their customer support team via phone, email, or online chat.

10. BoomTax

BoomTax is a tax software made for small businesses. It offers features to help with tax filing and compliance.

Features

BoomTax provides these key features:

- ACA Reporting: File Form 1095-C and Form 1094-C for ACA compliance.

- W-2 and 1099 Filing: File W-2 and 1099 forms electronically.

- TIN Verification: Verify the accuracy of payees' Taxpayer Identification Numbers (TINs).

- Unlimited Corrections: Make unlimited corrections to your filings without extra costs.

Pricing

| Service | Cost |

|---|---|

| ACA Reporting | Starts at $349 per company for up to 150 employees |

| W-2 and 1099 Filing | Starts at $39 for 12 forms |

User Experience

BoomTax has a simple, user-friendly interface that guides you through tax filing step-by-step.

Customer Support

BoomTax offers responsive customer support from tax professionals who can answer your questions and provide guidance.

Software Comparison

Here's a comparison of the top tax software for small businesses, highlighting their key features, pricing, and compatibility:

| Software | Pricing | Features | Compatibility |

|---|---|---|---|

| TurboTax | $89 - $189 | File taxes online, import W-2 and 1099 forms, track business expenses, report self-employment income | Windows, Mac, Mobile |

| H&R Block | $49.99 - $109.99 | Step-by-step guidance, deduction finder, audit support, import previous returns, mobile app | Windows, Mac, Mobile |

| QuickBooks Online | $10 - $30/month | Automatic tax calculations, financial reports, customizable invoices, accounting tool integration | Windows, Mac, Mobile |

| TaxAct | $49.95 - $109.95 | Accurate tax calculations, customizable reports, multi-state filing, audit protection | Windows, Mac, Mobile |

| Jackson Hewitt | $49.95 - $149.95 | Flat-rate pricing, unlimited state returns, tax professional help, accuracy guarantee | Windows, Mac, Mobile |

| TaxSlayer | $39.95 - $89.95 | Unlimited state returns, tax professional help, accuracy guarantee | Windows, Mac, Mobile |

| FreeTaxUSA | $14.95 - $39.95 | Free federal filing, affordable state filing, self-employed support, audit assistance | Windows, Mac, Mobile |

| Cash App Taxes | Free - $39.95 | Free federal and state filing, audit support, supports major IRS forms | Mobile |

| Block Advisors | $49.99 - $149.99 | Tax preparation, bookkeeping, payroll, business formation, tax consulting | Windows, Mac, Mobile |

| BoomTax | $349 - $599 | ACA reporting, W-2 and 1099 filing, TIN verification, unlimited corrections | Windows, Mac, Mobile |

When choosing tax software for your small business, consider:

- Pricing: Look for software that fits your budget and offers the features you need.

- Features: Ensure the software provides the necessary features for your business, such as tax filing, expense tracking, and payroll management.

- Compatibility: Choose software that works with your operating system and devices.

- User Experience: Opt for software with a user-friendly interface and good customer support.

Final Thoughts

Picking the right tax software for your small business can feel overwhelming with so many options. But by thinking about your needs, budget, and preferences, you can make a smart choice. Look at the features, cost, and if the software works with your devices.

When choosing tax software, focus on accuracy, ease of use, and good customer support. Think about your type of business, number of employees, and how complex your taxes are. Also, look for software that can grow with your business and work with other tools you use.

The best tax software for your small business makes doing taxes simpler, saves you time and money, and gives you peace of mind. By following the tips in this article, you can find tax software that fits your unique needs and helps your business thrive.

FAQs

How much does business tax software cost?

The cost of business tax software varies depending on the provider and the features you need. Here's a comparison of popular options:

| Company | Rating | Federal Filing Fee |

|---|---|---|

| TaxSlayer Self-Employed | 4.5 | $67.95 |

| TurboTax Premium | 4.3 | $129 |

| H&R Block Self-Employed | 3.3 | $115 |

| Cash App Taxes | 3.0 | $0 (Free) |

Some key points:

- Cash App Taxes offers free federal filing for individuals and small businesses.

- TaxSlayer Self-Employed and TurboTax Premium charge higher fees but provide more advanced features for businesses.

- H&R Block Self-Employed falls in the mid-range for pricing.

When choosing tax software, consider your business needs and budget. Free options may work for simple returns, while more complex situations may require paid software with additional tools and support.