Looking to fund your next big idea or cause? Here's a quick rundown of the 7 best crowdfunding platforms:

- Kickstarter: Best for creative projects

- Indiegogo: Flexible funding for various campaigns

- GoFundMe: Ideal for personal causes and donations

- SeedInvest: Equity crowdfunding for startups

- Fundrise: Real estate investing for the masses

- LendingClub: Peer-to-peer lending platform

- Kiva: Microloans for small businesses worldwide

Related video from YouTube

Quick Comparison

| Platform | Type | Min. Investment | Best For |

|---|---|---|---|

| Kickstarter | Reward | $1 | Creative projects |

| Indiegogo | Reward/Equity | $1 | Flexible campaigns |

| GoFundMe | Donation | No minimum | Personal causes |

| SeedInvest | Equity | $200 | Startup investments |

| Fundrise | Real Estate | $10 | Real estate investing |

| LendingClub | Debt | $1,000 (borrowing) | Personal loans |

| Kiva | Microloans | $25 (lending) | Small business loans |

Each platform has its own strengths. Kickstarter and Indiegogo are great for product launches, while GoFundMe shines for personal fundraising. If you're into investing, check out SeedInvest for startups or Fundrise for real estate. Need a loan? LendingClub offers peer-to-peer lending, and Kiva provides microloans for small businesses.

Choose based on your project type, funding needs, and target audience. Consider fees, payout times, and platform features before diving in.

Kickstarter: Project-Based Crowdfunding

Kickstarter has been the go-to name in crowdfunding since 2009. It's all about creative projects and rewards-based funding. Here's the lowdown:

How It Works:

Creators set a goal and deadline. Backers pledge cash for rewards. If the goal's hit, it's funded. If not, no one pays.

By the Numbers:

- $8+ billion pledged

- 41.71% success rate

- 253,079 funded projects

Games rule the roost with $2.54 billion pledged, followed by design and tech.

Costs:

Kickstarter takes 5% if you're funded, plus 3-5% for payment processing. Small pledges under $10 cost 5% + $0.05 each.

What Works:

- Aim low: $10,000 targets do better

- 30-day campaigns hit the sweet spot

- Launch in February, March, April, October, or November

Remember "Exploding Kittens"? That card game blew up, raising $8.7 million in under a month. They hit their $10,000 goal in just 8 minutes!

Creator Tips:

- Set realistic goals

- Build buzz early (6 months ahead is ideal)

- Make your campaign page pop

- Offer cool rewards

- Tap your network for early support

Suann Song, who founded Appointed, says:

"Kickstarter didn't just help me raise cash. It gave me credibility and momentum – that was priceless."

Who It's For:

Kickstarter shines for B2C projects, especially in creative fields. It's not your best bet for B2B or government-focused ventures.

2. Indiegogo: Flexible Funding Options

Indiegogo shakes things up in the crowdfunding world. Here's why:

Funding Flexibility

Indiegogo's big draw? You've got options:

1. Fixed Funding: Hit your goal, or get nothing.

2. Flexible Funding: Keep what you raise, even if you miss the mark.

This flexibility can be a game-changer. Just look at "Super Troopers 2" - they raked in $4.6 million on Indiegogo.

Global Reach and Diverse Projects

Indiegogo goes big:

- 223 countries and territories

- 25 currencies via PayPal

- 28 project categories

The numbers speak for themselves:

- Nearly 800,000 funded projects

- Over $1 billion raised

- 9 million backers

Costs and Considerations

Here's the fee breakdown:

| Fee Type | Amount |

|---|---|

| Platform Fee | 5% |

| Payment Processing | 3% + $0.30 per transaction |

| Flexible Funding (if goal not met) | Higher fee (exact % not specified) |

Indiegogo holds 5% until you deliver. It's their way of keeping things honest.

Success Stories and Strategies

Indiegogo's success rate is about 9%. But when it works, it works big:

- NOMATIC travel bag: $3 million raised

- HyperDrive Thunderbolt 3 USB-C Hub: Over $1 million

"Indiegogo let us fast-forward our five-year business plan", says Jon Roketenetz, CEO of BullRest, after raising $381,000 for their travel pillow.

Tips for Indiegogo Success

- Use InDemand to keep raising funds after your campaign

- Update backers monthly

- Set realistic goals

- Use Indiegogo's Education Center and Experts Directory

Indiegogo's flexibility and global reach make it a solid choice for creators who want options and a diverse backer base. But remember: with flexibility comes responsibility. Plan smart, communicate clearly, and deliver on your promises.

3. GoFundMe: Personal Fundraising

Since 2010, GoFundMe has been the go-to platform for personal fundraising. With over $30 billion raised, it's where people turn when they need financial help for emergencies, medical bills, or charitable causes.

What's Cool About GoFundMe?

- Works in 19 countries, including the US, Canada, and parts of Europe

- No platform fee for personal fundraisers in the US and Canada

- Takes 2.9% + $0.30 per donation for processing

- You keep what you raise, even if you don't hit your goal

How Much Does It Cost?

| What | How Much |

|---|---|

| Platform Fee | 0% |

| Processing Fee | 2.9% + $0.30 per donation |

| Tip (Your Choice) | 12-15% (donors can change this) |

So, if someone donates $100, you'd get $96.80 if they don't add a tip.

Tips to Raise More:

- Tell a story that grabs people (shoot for at least 550 characters)

- Use great, personal photos

- Set goals you can reach (GoFundMe will help you figure this out)

- Share on social media like crazy

- Keep people updated (this can triple what you raise!)

Rob Solomon, who used to run GoFundMe, said:

"As we've rolled this new model out in the US, we've had a huge amount of positive feedback from our community. It's a win-win move, and we think people in the UK will recognize the outstanding service we provide – and now we're offering that service for free."

Is It Safe?

You bet. GoFundMe has a Giving Guarantee and fraud protection. They've got people watching out for scams all the time. That's better than Facebook, which doesn't offer the same protection for fundraisers.

Who Should Use It?

GoFundMe is perfect if you're:

- Dealing with a personal crisis

- Facing big medical bills

- Supporting a cause you care about

It's easy to use and reaches tons of people, so it's great if you're new to this or want to connect with lots of potential donors.

sbb-itb-d1a6c90

4. SeedInvest: Startup Investment Platform

SeedInvest lets regular folks invest in startups. Since 2013, they've helped 235+ companies raise money from over 600,000 investors.

Here's the deal:

- You can invest as little as $200 (with Auto Invest)

- Most people put in $500 to $10,000

- There's a 2% fee (max $300)

- You'll probably wait 5+ years to see returns

SeedInvest is PICKY. Only 1% of startups make the cut. Why? They want to give you solid investment options.

Big Win Example:

Heliogen raised $1.6 million on SeedInvest in 2017. Their value? $20 million. In 2021, they went public at $2 BILLION. Not too shabby.

Who Can Invest?

Anyone. You don't need to be a millionaire. SeedInvest offers:

- Regulation CF: For everyone

- Regulation A+: Bigger raises, still open to all

They focus on tech and consumer businesses, with companies raising $100,000 to $50 million.

For Startups:

Want to raise money on SeedInvest? Here's what it'll cost you:

- 7.5% of what you raise

- 5% warrant coverage

- Up to $4,000 in extra costs

SeedInvest's CEO, Ryan Feit, put his money where his mouth is:

"We hit our $3 million goal in a week. Then we took another $1.15 million before closing. Over 3,000 investors checked us out, and 400+ new people signed up."

Tips for Investors:

- Spread your bets with Auto Invest

- Be ready to wait (startups take time to grow)

- Do your own research (even though SeedInvest vets companies)

5. Fundrise: Real Estate Investment Platform

Fundrise makes real estate investing accessible to everyday people. Since 2012, they've helped over 393,000 investors put money into more than $7 billion worth of property. Here's what you need to know:

Start Small, Think Big

You can jump in with just $10 for a standard account. That's cheaper than most lunches! But for an IRA, you'll need $1,000 to start.

Fees That Make Sense

| Fee Type | Amount |

|---|---|

| Annual Advisory Fee | 0.15% |

| Real Estate Funds Fee | 0.85% |

| Innovation Fund Fee | 1.85% |

| Fundrise Pro Membership | $99/year or $10/month |

These fees are competitive, especially for access to private real estate markets.

Plans for Every Investor

Whether you want growth, income, or a mix of both, Fundrise has options. They've tailored their offerings to fit different investor goals.

Numbers That Count

Long-term investors have seen an average annual income return of 4.81%. That's pretty solid in today's market.

What You Should Know

- Investments aren't FDIC insured

- Expect a five-year lock-up period for eREIT or eFund shares

- Early redemptions might cost you

- Quarterly redemptions aren't guaranteed

Ben Miller, Fundrise's CEO, says:

"We're democratizing access to high-quality real estate investments that were previously only available to large institutions and the ultra-wealthy."

Is Fundrise For You?

It might be if you:

- Have a long-term investment outlook

- Want to get into private real estate markets

- Can handle less liquidity than public markets offer

Fundrise outperformed public REITs in five out of seven years from 2017 to Q3 2023. That's impressive, but remember: past performance doesn't guarantee future results.

Quick Tip: Start with their Starter Portfolio at $500. They offer a 90-Day Guarantee, so you can get your original investment back if you're not happy within the first 90 days.

Fundrise is shaking up real estate investing. It's not risk-free, but if you want to diversify into real estate without a huge bank account, it's worth a look.

6. LendingClub: Peer-to-Peer Lending

LendingClub has been shaking up the lending world since 2007. They've dished out over $60 billion in loans to more than 3 million members. How? By connecting borrowers and investors online.

Here's the scoop on LendingClub:

Loan Basics:

- Borrow $1,000 to $40,000

- Pay it back in 2 to 5 years

- APRs from 8.98% to 35.99%

- Origination fee: 3% to 8% of your loan

These loans are perfect for crushing credit card debt, consolidating bills, or handling those "uh-oh" moments. But don't try to use them for school or playing the stock market.

Who Gets the Green Light? You need to be:

- A U.S. citizen, permanent resident, or long-term visa holder

- At least 18 years old

- The proud owner of a bank account

- Someone with 3+ years of credit history

LendingClub likes to see credit scores over 600, but their typical borrowers are rocking 700+. They also prefer you're not drowning in debt (aim for a debt-to-income ratio under 40%).

For the Money Makers: LendingClub isn't pure peer-to-peer anymore, but investors can still get in on the action. Historically, they've seen returns of 10% to 15%. Not too shabby.

Watch Out for These Fees:

| Fee Type | How Much? |

|---|---|

| Origination | 3% to 8% of your loan |

| Late Payment | $15 or 5% of what you owe (whichever's more) |

| Insufficient Funds | $15 |

Pro Tip: Curious about rates? Pre-qualify on their site. It won't ding your credit score, and you'll get a sneak peek at what you might qualify for.

Ben Miller, CEO of Fundrise, says:

"We're democratizing access to high-quality investments that were previously only available to large institutions and the ultra-wealthy."

He's talking real estate, but the same idea applies to LendingClub. It's bringing lending opportunities to the masses.

Is LendingClub Your Match?

It might be if:

- Your credit's decent (or better)

- You're drowning in debt and need a life raft

- You need cash ASAP (45% of loans are funded within 24 hours of approval)

- You're cool with borrowing online

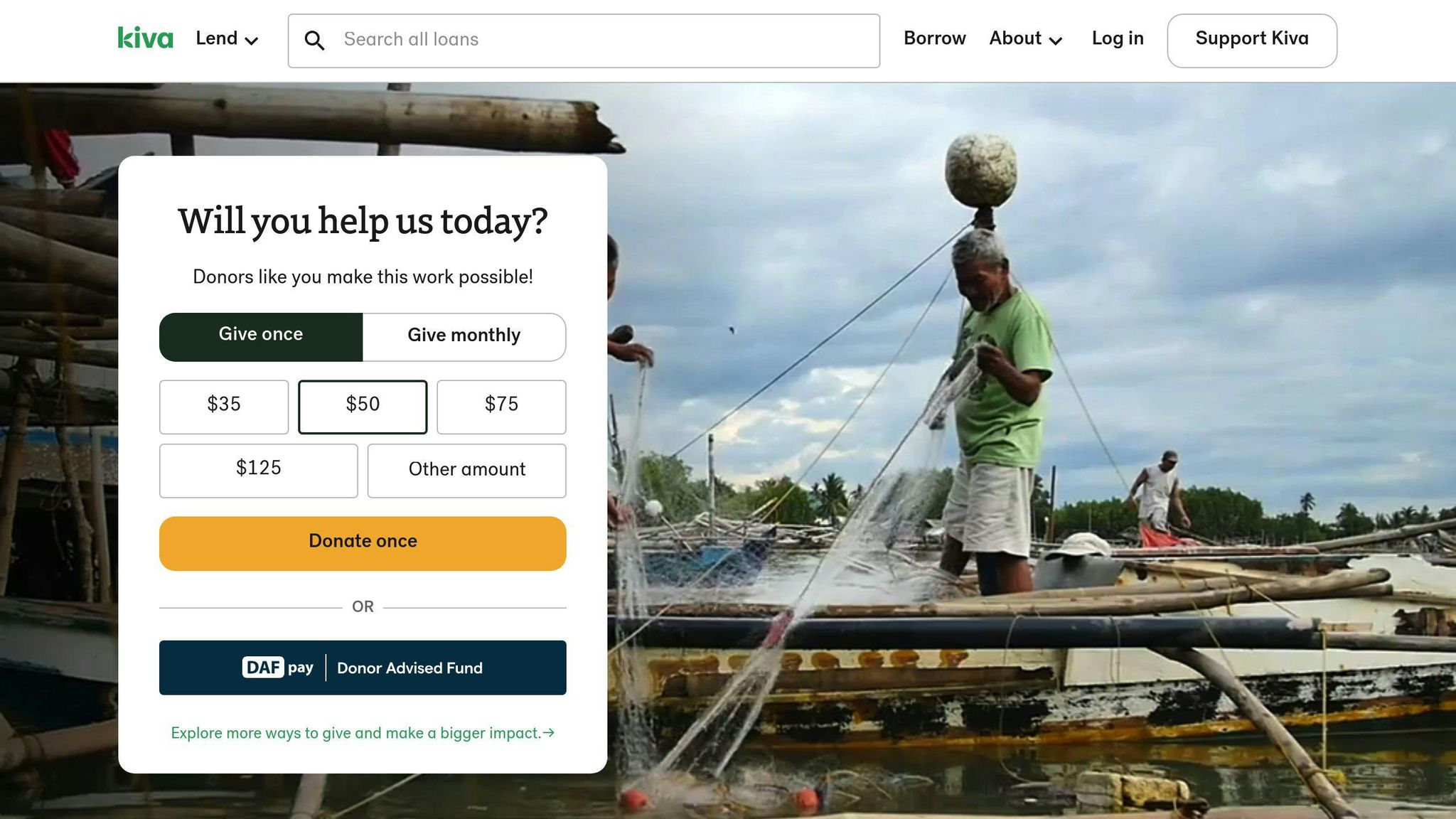

7. Kiva: Small Business Microloans

Kiva isn't your typical crowdfunding platform. They're all about microloans for entrepreneurs worldwide, with a special focus on developing countries. Since 2005, this non-profit has been playing matchmaker between lenders and small business owners.

Here's the scoop on Kiva:

- Loans from $1,000 to $15,000

- 0% interest rate (yes, you read that right)

- Pay back in 6 months to 3 years

- Lend as little as $25

Kiva's reach? It's huge. They've got over 290 microfinance buddies in 77 countries, helping entrepreneurs who'd normally get the cold shoulder from traditional banks.

So how does it work? Borrowers apply through local partners, lenders pick projects they like, and when the funding goal is hit, the entrepreneur gets their cash. As they pay it back, lenders can either reinvest or cash out.

Let's talk numbers:

| Metric | Value |

|---|---|

| Total Loans | $1.7 billion+ |

| Borrowers Helped | 2.5 million |

| Repayment Rate | 98.5% |

| Number of Lenders | 2.1 million |

Kiva Zip, launched in 2011, is their secret weapon. It offers 0% interest loans by tapping into an entrepreneur's personal network for credibility. It's a game-changer for folks who couldn't get a loan if their life depended on it.

"Kiva was my golden ticket", says Maria, a shop owner in Peru who snagged a $1,500 loan in 2022. "Fast forward a year, and I've beefed up my inventory and even hired two part-timers."

Want to borrow? Here's your game plan:

- Craft a killer business plan

- Get your financial ducks in a row (tax returns included)

- Paint a clear picture of your business and why you need the loan

- Leverage your network during the 15-day private fundraising period

For you lenders out there, Kiva's website lets you browse entrepreneur profiles. Filter by industry, region, or whatever floats your boat to find projects that light your fire.

Kiva's proving that even small change can make big waves. By focusing on character over credit scores, they're not just changing lives - they're fueling global entrepreneurship, one tiny loan at a time.

Platform Features at a Glance

Let's dive into the key features of our top 7 crowdfunding platforms. This breakdown will help you pick the best option for your equity, debt, or donation needs.

| Platform | Type | Fees | Minimum Investment | Payout Time | Best For |

|---|---|---|---|---|---|

| Kickstarter | Reward-based | 5% platform + 3-5% processing | $1 | ~14 days | Creative projects |

| Indiegogo | Reward/Equity | 5% platform + 3% + $0.30 processing | $1 | 15 business days | Flexible campaigns |

| GoFundMe | Donation | 2.9% + $0.30 processing | No minimum | 2-5 business days | Personal causes |

| SeedInvest | Equity | 7.5% of raised funds + up to $4,000 in fees | $200 (Auto Invest) | Varies | Startup investments |

| Fundrise | Real Estate | 0.15% advisory + 0.85% management | $10 | Quarterly | Real estate investing |

| LendingClub | Debt | 3-8% origination fee for borrowers | $1,000 (borrowing) | 1-4 business days | Personal loans |

| Kiva | Microloans | 0% interest for borrowers | $25 (lending) | 6-12 months (repayment) | Small business loans |

Kickstarter: The big name in creative project funding. It's all-or-nothing, so you'd better hit that goal. Fees? 5% plus 3-5% for processing. Not bad if you're confident in your project.

Indiegogo: More wiggle room here. Choose fixed or flexible funding. Fees match Kickstarter, but that flexible option? It's a lifesaver if you fall short.

GoFundMe: Personal causes are the name of the game. No platform fee, but you'll still pay 2.9% + $0.30 for processing. Want your cash fast? 2-5 business days and it's yours.

SeedInvest: Equity crowdfunding with a twist. Yes, the 7.5% fee looks high, but you're getting vetted investors. Got $200? You're in the game with Auto Invest.

Fundrise: Real estate for the masses. Start with just $10. The 1% total fee is a steal in the property market.

LendingClub: Debt's the word here. Borrowers pay 3-8% to start, but investors can jump in with $1,000. It's peer-to-peer lending made simple.

Kiva: 0% interest microloans. That's right, zero. Lend with $25, borrow up to $15,000. Small businesses, this one's for you.

"We're democratizing access to high-quality investments that were previously only available to large institutions and the ultra-wealthy", says Ben Miller, CEO of Fundrise.

This quote sums it up. Crowdfunding isn't just changing the game; it's creating a whole new playing field. Whether you're the next big artist, a budding entrepreneur, or just want to help out, there's a platform with your name on it.

How to Pick Your Platform

Picking the right crowdfunding platform can make or break your campaign. Here's how to navigate the crowdfunding landscape:

Know Your Funding Type

First, figure out what kind of funding you need. Different platforms cater to different types of projects:

| Funding Type | Best For | Example Platform |

|---|---|---|

| Reward-based | Creative projects | Kickstarter |

| Donation-based | Personal causes | GoFundMe |

| Equity-based | Startups | SeedInvest |

| Debt-based | Small businesses | LendingClub |

Set Clear Goals

How much do you need to raise? By when? Answering these questions will help you pick a platform that fits your needs.

Understand the Fees

Crowdfunding isn't free. Here's a quick look at some platform fees:

| Platform | Platform Fee | Processing Fee |

|---|---|---|

| Kickstarter | 5% | 3-5% |

| Indiegogo | 5% | 3% + $0.30 |

| GoFundMe | 0% | 2.9% + $0.30 |

Check the Fine Print

Some platforms use an all-or-nothing model (like Kickstarter), while others offer flexible funding (like Indiegogo). Make sure you know what you're signing up for.

Evaluate Platform Features

Look for platforms with:

- An easy-to-use interface

- Good social sharing tools

- Solid customer support

"Time is money. Starting with a large number of fans is a no-brainer. As such, crowdfunding is the perfect funding route for Rnwl", says the former CEO of SyndicateRoom.

This quote highlights why it's smart to choose a platform with lots of active users.

Research Similar Campaigns

Check out successful campaigns in your niche. For example, CircleUp focuses on consumer and retail companies, while MicroVentures offers opportunities in FinTech and space travel.

Consider Multiple Platforms

Don't limit yourself to just one platform. Using multiple platforms can help you reach more people and boost your chances of success.